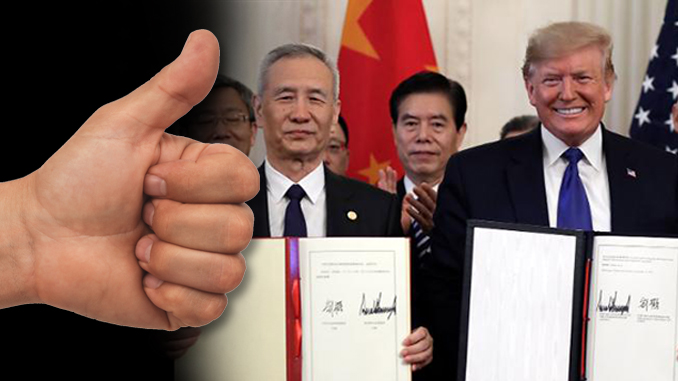

President Trump is set to sign a renegotiated deal in an attempt to address trade inequities.

By Mark Anderson

President Donald Trump will formally sign a “phase one” trade deal with China at the White House Jan. 15, which reportedly contains several positives for the U.S. in terms of rebalancing U.S.-China trade relations. This is expected to correct China’s “bad behavior” in specific areas.

In the 86-page agreement, according to a White House overview, “China has agreed to structural reforms in areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange.”

Those are the key areas in which China has misbehaved for far too long, most analysts would agree, although the dominant anti-tariff internationalists have the clout (and Trump’s ear) for promoting their view and burying a more populist-nationalist approach to achieving economic equilibrium and true prosperity with more domestic self-sufficiency [i.e., autarky], less dependence on international trade and the creation of a sovereign U.S. currency free of debt and interest.

Regarding technology transfer, the internationalist Peterson Institute for International Economics (PIIE) produced a June 2018 paper that reveals some concerns the White House has as it  enters into the first phase of the U.S.-China pact, with high hopes to soon proceed to phase two.

enters into the first phase of the U.S.-China pact, with high hopes to soon proceed to phase two.

The paper noted: “In a report issued March 22, 2018, the United States Trade Representative cited numerous instances of forced technology transfer and failure to protect U.S. intellectual property from infringement or theft . . . . A broad range of experts and market observers agree that China has repeatedly forced foreign multinational corporations [MNCs, including, of course, American domiciled corporations] to transfer technology to [Chinese] indigenous firms as a condition for market access and that China has persistently failed to protect the intellectual property of foreign firms.”

Discussing the options the White House has as it moves away from levying tariffs, the PIIE report continued: “At the same time, stock markets, American industry, and farm sectors dependent on exports to China have been worried . . . by the prospect of a U.S.-China trade war . . . . Fortunately, there is a better way. Instead of indiscriminate tariffs, carefully targeted sanctions should be imposed on the Chinese entities directly involved in technology misappropriation.”

The White House overview adds: “The agreement includes a strong dispute resolution system to ensure effective implementation and enforcement. As a result, we will be able to ensure full enforcement of this phase-one agreement and the reforms it includes. As a part of this agreement, the United States has agreed to significantly modify its Section 301 tariffs.”

“When Trump and Chinese officials announced the phase-one agreement in mid-December [of 2019], the U.S. agreed to shelve plans to impose new tariffs on $160 billion of Chinese goods that had been set to take effect Dec. 15,” USA Today noted. Thus, the tariffs that Trump has threatened or imposed so far on Chinese goods are being described largely as a means to prod China to negotiate—not so much as a permanent, proper method of economic protection and revenue source for the U.S. Treasury.

Forbes business writer Charles Wallace on July 21, 2018 described the volatile situation Washington and China are trying to settle: “Trump is trying to force China to stop stealing intellectual property from U.S. companies,” since China’s rules that enable such theft constitute “a blatant violation of World Trade Organization rules that Beijing agreed to when it joined the WTO in December 2001.”

Wallace continued, “Each time Trump raises his bet by adding new tariffs, China responds with an equal amount of import duties on American goods. Both sides want the other to blink first. But here’s the tricky part: While the U.S. bought $505 billion of goods from China last year [2017], the Chinese only bought $129 billion worth of U.S. goods [a U.S. deficit of $376 billion, which is typical].

“So, one strategem for the Chinese is to hit back in another, non-tariff way. Such as making their goods cheaper so that the Trump tariffs don’t make a difference. Enter the renminbi. China has allowed the currency to decline 7.6% against the dollar in just the last four months [as of mid-2018]. That’s a huge drop, and almost negates Trump’s threatened 10% import tariffs on some Chinese products.”

It indeed may be of strategic necessity to reign in China’s abuses and keep the communist-capitalist slave state placated—especially considering the heavy dependency the U.S. has long had on China for underwriting the U.S. dollar. And while Trump wants to keep American farmers and other exporters happy, in order to uphold those economic sectors (and to keep his current campaign promise to get a “rebalance” deal with China), the pressure to strictly limit or phase out U.S. tariffs on Chinese and other foreign imports seems overwhelming. This may prove unfortunate.

The real test of whether U.S. trade with China has been “rebalanced” will be if the notoriously massive U.S. trade deficit with China—which for decades has cost the U.S. hundreds of billions of dollars per year while giving China a surplus it leverages to build its military and cyber-spying capabilities—will finally be laid to rest so truly balanced and fair trade will ensue. Another test will be whether the U.S. will maintain sufficient (not punitive) tariffs on imports from China (and elsewhere) in order to pump badly needed, externally sourced revenue into the U.S. Treasury that is not derived from the already over-taxed American domestic economy.

Mark Anderson is AFP’s roving editor. Email him at [email protected].