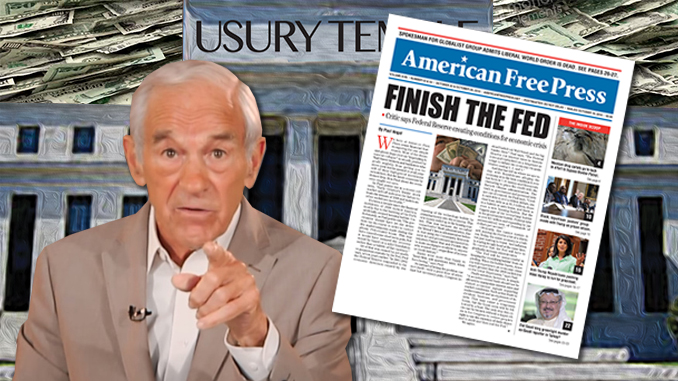

The new Issue 43 & 44 of American Free Press is in the mail, and digital subscribers can read their newspaper online here. Not yet a subscriber? Click here for subscription options and don’t miss another issue of AFP. In our front-page article, Fed critic Ron Paul says the Federal Reserve is creating conditions that make a devastating economic crisis “inevitable.”

By Paul Angel

We here at American Free Press resist financial fearmongering for one simple reason. Most of the doom-and-gloom hype over an “impending financial collapse” is usually pushed by Wall Street brokers and banksters who profit mightily from getting you to move your stocks around or avail yourself of their high-priced investment newsletters. But the latest comments by former Rep. Ron Paul about the economy caught our eyes.

As Paul points out in a recent column, early October’s “frantic stock market sell-off indicates the failure to learn the lessons of 2008 and makes another meltdown inevitable.”

It’s been a decade since the financial meltdown of 2008 rocked America, mostly due to the bursting of the Fed’s artificially created housing bubble. Unfortunately, as Paul points out, “The government should have let the downturn run its course in order to correct the malinvestments made during the phony, Fed-created boom. This may have caused some short-term pain, but it would have ensured the recovery would be based on a solid foundation rather than a bubble of fiat currency.”

All of that was caused by yet another gargantuan mistake by the Fed, Paul says, seven years earlier. “In 2001-2002 the Federal Reserve responded to the economic downturn caused by the bursting of the technology bubble by pumping money into the economy. This new money ended up in the housing market.

All of that was caused by yet another gargantuan mistake by the Fed, Paul says, seven years earlier. “In 2001-2002 the Federal Reserve responded to the economic downturn caused by the bursting of the technology bubble by pumping money into the economy. This new money ended up in the housing market.

This was because the so-called ‘conservative’ Bush administration, like the ‘liberal’ Clinton administration before it, was using the Community Reinvestment Act and government-sponsored enterprises Fannie Mae and Freddie Mac to make mortgages available to anyone who wanted one—regardless of income or credit history.”

Banks were more than happy to “lend first, ask questions later, when foreclosing,” says Paul.

So instead of letting the problem correct itself—with a good dose of attendant but necessary pain, Congress instead bailed out Wall Street and the big banks. How? Paul says, “The Federal Reserve cut interest rates to historic lows and embarked on a desperate attempt to inflate the economy via quantitative easing 1, 2, and 3.”

And this has left us where we are today, with Republicans alleging the economy is in the best condition it ever has been in U.S. history and Democrats clamoring to place the credit with the Barack Obama administration. The truth is, government and personal debt are out of control. As Paul says, “Credit card debt is over a trillion dollars, student loan debt is at $1.5 trillion, there is a bubble in auto loans, and there is even a new housing bubble. But the biggest part of the ‘everything’ bubble is the government bubble. Federal debt is over $21 trillion and expanding by [an astronomical] tens of thousands of dollars per second.”

Obviously, this cannot sustain itself, leaving the Fed in a bit of a dilemma. Today, the entire economy is a bubble just waiting to burst. And inflation is rearing its ugly head at the same time. To control that, the Fed will have to gradually increase interest rates.

“The Fed will be unsuccessful in keeping the ‘everything bubble’ from exploding. When the bubble bursts, America will experience an economic crisis much greater than the 2008 meltdown or the Great Depression,” says Paul. Paul’s solution, however, is simple.

“A secretive central bank should not be allowed to manipulate interest rates and distort economic signals regarding market conditions. Such action leads to malinvestment and an explosion of individual, business, and government debt. This may cause a temporary boom, but the boom soon will be followed by a bust. The only way this cycle can be broken without a major crisis is for Congress to restore people’s right to use the currency of their choice and to audit and then end the Fed.”

We agree.

I petition to dissolve the Federal Reserve.

Andrew Jackson, John Kennedy tried to shut down the Fed and we know the rest of the story.

trump will cover the fed.

We can’t Finish the Fed because the entire economy, currency and country would collapse.

The Fed has to be SEIZED and ALL officers arrested and charged with treason and stolen money repatriated by military force if needed.

Nationalize the Fed as an interest free bank under the NEW Treasury Department.