•Without real monetary, banking reform, it matters not which party is in power in D.C.

By Keith Johnson —

The 2014 midterm elections brought many changes to the American political landscape, most notably the purging of Democrats from both the House and Senate. That means the Republican Party will seize control of the 114th Congress come January with Senator Mitch McConnell (R-Ky) taking the helm as majority leader in the Senate. Will these changes bode well for the United States economy, or does this new majority bring with it a whole new set of problems?

For one perspective, this AMERICAN FREE PRESS reporter consulted film producer Patrick S. J. Carmack, whose 1995 documentary “The Money Masters” helped bring mainstream awareness to the origins of fractional reserve banking and how international bankers have used it to seize control of the American economy and political structure.

When asked if the incoming lineup of politicians stood a better chance than their predecessors of steering the nation through the next four years of financial crises, Carmack replied: “As I imagine you know, the GOP is slightly more pro-bank than the Democrats. Only if Rand Paul has earned enough power and political capital with McConnell to advance some of his Austrian School economics policies will another economic downturn be avoided. McConnell is clueless on the economy, as is the GOP in general. They differ from the Democrats only by degree, not on principles.”

Carmack stressed that his endorsement of Austrian economics principally referred to its position on fiat currencies and opposition to excessive government interference in the marketplace.

“Regarding fiat currencies,” he explained, “the Austrians are correct that absent a constitutional amendment as proposed by [late economist] Milton Friedman—setting either a 0% or low, fixed rate of monetary growth—only tethering the currency to a commodity, such as gold, can discipline governments not to debase their currency. The Austrians are also correct that in every instance in which fiat currencies have been untethered from gold or some other commodity. The governments involved have sooner or later printed more money than an increasing supply of goods warrants, resulting in price inflation. We all know this has and is happening in the U.S., and quite dramatically in the last few years.”

Carmack went on to suggest that any significant reforms to the U.S. economy will be difficult since its control was long ago surrendered over to the Federal Reserve, the International Monetary Fund and especially the Bank of International Settlements.

“They seek world power, and care nothing about the human suffering that will result as they manipulate economies to consolidate it,” he explained. “Those few who have any qualms about it console themselves with the thought that in the end, control of the world by them will be more benevolent and will end wars, and so on. Of course the opposite will be the reality—wars will be endless. Other than Rand Paul, there is no way any politician in the GOP or Democrats would stand up to them or even know how.”

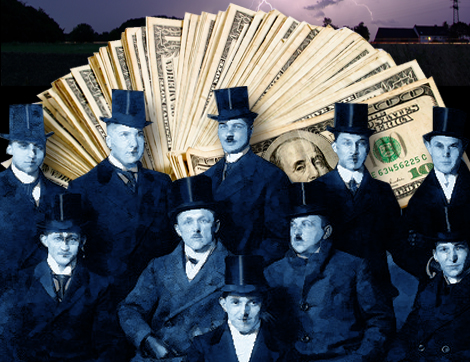

The ever-increasing consolidation of banking power has also contributed to neutralizing any meaningful political intervention, as Carmack explained: “The number of banks in the U.S. has declined from a high of over 18,000 to just under 7,000 now. Over 10,000 U.S. banks have closed since 1984. This has, of course, contributed to the concentration of deposits and loans in fewer and fewer, larger banks. In the U.S. at present, four banks—Bank of America, Chase, Citibank and Wells Fargo—control the majority of assets and deposits. Throw in Goldman Sachs and the total approaches $9 trillion in assets—close to 60% of the total. The other 7,000 banks control about 40%. This concentration of economic wealth and power in the hands of just five men—the CEOs of those banks—is quite obviously a danger to democratic government, particularly when you realize that much of that economic power has gone toward consolidating and protecting that power through political PACs and media control, both direct and indirect.”

Carmack says Americans will now want the GOP to tackle the hot-button issues of economic stability and inequality, tasks most Democrats halfheartedly addressed during their eight years in control of Congress.

“The cosmetic changes adopted in the [2010] Dodd-Frank [Wall Street Reform and Consumer Protection] Act simply did not go to the root problem: fractional reserve banking,” Carmack said. “Until the power to create money out of nothing is taken away from the banks and 100% reserve banking instituted, the concentration of wealth and economic instability both in the U.S. and worldwide will accelerate and the growing income inequality between the haves and have-nots and the 1% versus the 99% will get much worse.”

SUGGESTED READING:

- The SECRETS of the FEDERAL RESERVE

- THE WEB OF DEBT

- OUT OF DEBT, OUT OF DANGER

- THE LOST SCIENCE of MONEY

Keith Johnson is a writer based in Tennessee. He can be contacted at [email protected].

When chaos has ensued, their plan would be to bring back the gold standard, which will be more worthless paper, coins and electronic entries, supposedly backed by gold in a vault somewhere that they will control; use as they like in reality.

See visual and links to workable tools here.

Why do we not have a currency backed by wheat or a different variety of grains?

My dear grandmother had many wonderful sayings. One was “Too soon old – Too late smart.”

For some this knowledge may not be “TOO LATE.”

Take care.