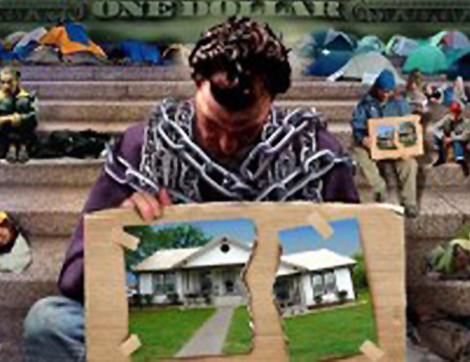

• America’s middle class sinking under the poverty line

By Victor Thorn

Amid White House claims that the economy is rebounding, Americans are actually being placated by a vast illusion. During the Great Depression, soup lines stretched around city blocks.

In 2013, these same soup lines exist, except in a different form. Facilitated by yearly trillion dollar deficits, one-sixth of all citizens now collect food stamps. This rapidly expanding welfare state also includes skyrocketing disability claims and other government programs that have provided the necessary optics for what many are calling an invisible depression.

But calculated PR campaigns can only conceal these calamities for so long, especially a disturbing slide toward poverty for middle class workers, many of them white. In a monumental July 28 article, the AP’s Hope Yen revealed that 79% of United States adults will, at least once in their lifetime, face prolonged stretches of unemployment, reliance on government aid, or income levels below the poverty line.

While corporate media propagandists fixated for months on George Zimmerman’s alleged profiling of Trayvon Martin, the real story facing our country lies in classism, not racism. Harvard Professor William Julius Wilson emphasized, “It’s time that America comes to understand that many of the nation’s biggest disparities . . . are increasingly due to economic class position.”

Yen took it a step further. “Hardship is particularly growing among whites.” Although poverty rates for blacks and Hispanics triple that of whites, by sheer numbers those living in a monetary danger zone—characterized as an income level of $23,012 for a family of four—are now 41.5% white.

Despite white families still possessing, on average, six-times the overall wealth of blacks and Hispanics, on July 31 Fox Business Network analyst Charles Payne offered this perspective. “While the nation has been sidetracked with a variety of news headlines promoting racial animosity and a recent speech by President Obama suggesting treatment of black people is moving backwards, there is a major crisis in white America that’s going unnoticed or ignored.”

The reasons are plenty. After the housing bubble burst, many homeowners abruptly realized that they owed more on their residences than they were worth, a condition known as being underwater. Also, even though working class whites still comprise the largest demographic employment bloc, fears regarding Obamacare are compelling companies to primarily only hire part-time or temporary help. In fact, of all jobs created this year, 77% were part-time.

Other factors must be considered. For instance, if Obama’s amnesty bill passes, upwards of 20 million more foreigners will be competing for lower-end jobs. In Appalachia, an ongoing war against coal has decimated many mountain communities, whereas Midwest factory towns still suffer from the effects of outsourcing.

Moreover, insidious programs such as Agenda 21 are gutting rural white America, especially in the heartland, in an attempt to urbanize our population. With recent college graduates struggling to find entry-level jobs, a rise in white single-mother households, increased payroll taxes, and a largely unreported rise in poverty among whites near retirement age, it appears as if the new normal for once thriving white Americans seems to be one of economic dystopia.

The Obama administration’s attempt to “level the playing field” seems to be working according to plan.

Too ‘Rich’ for Welfare

• Single white woman recounts her struggle to pay the monthly bills

Despite the rosy scenarios put forth by Washington elites, an increasing number of single white females are facing the harsh reality that just because you have a job doesn’t mean you’re not considered poor.

For this week’s edition, this writer to spoke to a single white female in her late 40s who lives in rural Pennsylvania. Out of concern that her candid statements about the perils of today’s working poor could impact the various jobs she works or embarrass her in the local community, AMERICAN FREE PRESS decided not to reveal her identity. Instead, she asked to be referred to as “Nikki.”

AFP asked Nikki to describe her schedule.

“I work 36 hours a week as a secretary, and then afterward I put in two or three hours each evening at a local retail store for minimum wage,” she said. “So, I get up at six in the morning and usually don’t get home until seven or eight at night. It’s a good thing both my kids are grown and on their own, because if they were little, I’d never see them.”

Nikki’s jobs don’t end there. “On the weekends, I do some gardening for a couple of elderly people to earn a few extra bucks,” she added.

Even with a seven-day workweek, Nikki’s financial situation isn’t pleasant. “Between rent, a car payment, car insurance, gas money and paying my utilities, I usually only have 10 to 15 dollars left over by week’s end,” she said.

At the risk of getting too personal, this writer inquired about Nikki’s circumstances. “I got divorced a few years ago,” she began, “and I’m still gun shy about starting a new relationship. For better or worse, I’m on my own. It’s all up to me.”

When prompted to expand upon some of her hardships, Nikki reluctantly stated, “This is embarrassing, but a few weeks ago I needed some new outfits for work. Being low on cash, I had to buy used clothes at a second-hand shop.”

She continued: “Last June my friend asked if she could borrow $200 to pay for an overdue doctor’s visit. I didn’t have that kind of money lying around. Do you know how hard it was turning down a gal I’d known since high school? I felt sick for days.”

As to whether she tried getting government assistance, Nikki provided another interesting element to her story. “At the beginning of this year I swallowed my pride and made an appointment at the welfare office,” she said. “After poring over my records, they said I made $53 a month too much to qualify for food stamps and their subsidized fuel program. So, even though I’m always broke, I’m too rich for welfare.”

Pausing a moment, Nikki joked: “They say money can’t buy happiness, but it sure would help put a down payment on it.”

Posed with what would happen if a catastrophic expense suddenly arose, Nikki replied, “If the engine in my car blew up, I’d be ruined. I can’t even afford to make a down payment on another one. Plus, since I don’t have health insurance, I’d never recover from a major hospital bill. I’d be bankrupt.”

Despite her financial woes, Nikki wanted to clarify something. “I don’t want your readers to think I’m complaining. Even though things are rough, I work hard, still have my faith, and except for a few credit card bills, I’m mostly out of debt. Better yet, although everyone in my family is struggling, we all pull together and help each other whenever we can.”

Providing a final thought, Nikki wondered: “The only thing I can’t figure out is, shouldn’t working three jobs and being exhausted all the time get me at least a little piece of the American Dream? For some reason, I can’t seem to catch that brass ring.”

Think We Got It Better Than the Chinese?

• U.S. matches Turkey, Mexico, China in divide between rich and poor

Not everyone in America today is suffering. Some, especially the wealthiest, have been exploiting the system for gain, while everyone else gets poorer. An April 24 commentary in Investor’s Business Daily (IBD) set the record straight: “Obama got all he wanted in his first two years in the White House when Democrats had solid control of Congress—a massive stimulus, auto industry bailouts, temporary middle-class tax cuts, vast new regulations on businesses and Obamacare.”

Yet, citing 2010 census data, IBD revealed that from 2009-2010, “The richest 7% of Americans saw net worth climb 28%. The rest of the country saw their net worth drop 4%.”

Of course, Barack Obama’s inept economic policies cannot solely be blamed on him. A recent Congressional Budget Office report exposed rampant classism at play. Over the past 30 years, income for the top 1% rose 241%. Comparatively, incomes for the bottom 40% of wage earners rose only one-16th of this total.

The same applies to net worth. On July 29 political journalist Jane Timm wrote, “The bottom 4% of the population owns just 0.3% of the nation’s wealth, while the top 20% has 84% of the nation’s wealth.”

In terms of income inequality, only three developed nations possess higher disparities than the United States: Turkey, Mexico and China.

Pages of additional data could be provided to reinforce this point, but considering that Obama has been one of the banking industry’s favorite tools, he’s done little to curb Wall Street. Ominously, prior to every great financial catastrophe in American history, financial disparity had reached a peak.

The New Oil Boom

With manufacturing stagnant in the United States, unemployment for college graduates hovering between 8 and 9% and a ballooning trade deficit with China, it appears as if only one industry offers Americans a chance at prosperity reminiscent of our former heyday. Loved by some and loathed by others, oil production and “fracking” outfits are booming in south Texas, the Bakken shale fields in North Dakota and parts of northwest Pennsylvania.

According to estimates, if given a green light by federal regulators, oil and gas production jobs could nearly double in the next seven years. Speculators are feverishly hopeful, especially with the release of a June report by Leonardo Maugeri, a fellow at Harvard’s Kennedy School of Government, who claimed that by 2017 the U.S. will be the world’s largest oil producer.

These latest technologies and energy advancements have become so pronounced that Saudi Arabia’s Prince Alwaleed bin Talal recently fretted that the U.S. oil boom threatens the profitability of every member of the Organization of the Petroleum Exporting Countries (OPEC).

His fears were seconded by Council on Foreign Relations energy expert Blake Clayton, who told CNN on June 19, “OPEC’s ability to keep prices at today’s levels could come under tremendous pressure.”

At a time when America stagnates as a predominantly service economy, domestic U.S. oil production could provide hope for a new beginning for the United States.

Victor Thorn is a hard-hitting researcher, journalist and author of over 50 books.