• Swiss bank at heart of parasitic financial network that fixed bank loan rates to gouge consumers

By Pete Papaherakles

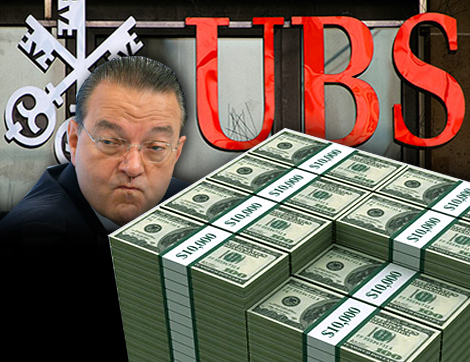

On December 19, UBS, a Swiss bank, agreed to pay an unprecedented $1.5B to United States, British and Swiss authorities as punishment for manipulating the London banking loan rate known as LIBOR, dwarfing the $450M fine paid by Barclays Bank in July. UBS became the second bank to settle criminal charges with one of the biggest fines in history.

LIBOR, which stands for the London Inter-Bank Offered Rate, is the rate at which the major banks of London are able to borrow money from one another. LIBOR is supposed to be an overall assessment of the health of the financial system. If the banks feel confident about the state of things, they offer a low interest rate. But if the member banks feel a low degree of confidence in the financial system, they report a higher rate. Member banks submit the rates at which they borrow to a regulating agency which then lops off the top 25% and the bottom 25% on the list and publishes the average of the remaining rates.

LIBOR is used as a basis for at least $350T worth of financial contracts and derivatives, including mortgages, car loans, student loans, credit card loans and virtually all forms of borrowing as this rate dictates the rate banks around the world charge the public to borrow money. LIBOR rates are calculated for 10 currencies and 15 borrowing periods ranging from overnight to one year and are published daily at 11:30 a.m., London time.

The LIBOR scandal arose when it was discovered that major banks were falsely inflating or deflating their rates so they could profit from trades, or to give the impression that they were more creditworthy than they were.

The charges made against UBS have made all the other banks involved with LIBOR nervous, because not only was UBS accused of manipulating the rates for its own benefit, it colluded with other banks to exploit the public as well.

In the Barclays case, much of the manipulation appeared to occur by traders hoping to make the bank look healthier during the crisis and less for profit—though profits were certainly a big motivator. For UBS, the game was much more about lining its pockets than anything else. Two of the many victims of LIBOR fraud were the quasi-federal housing agencies Fannie Mae and Freddie Mac, which together claim to have lost more than $3B.

The U.S. Commodity Futures Trading Commission says it found more than 2K instances of unlawful conduct involving dozens of UBS employees and that the bank colluded with at least four other panel banks. According to the Department of Justice (DoJ) just one UBS trader generated $336M in illicit profits between 2007 and 2009. Two former UBS traders, Tom Hayes and Roger Darin, were sued by the DoJ and charged with “conspiring to manipulate” LIBOR.

Under the Sherman Antitrust Act, price-fixing conspiracies are illegal in the U.S. and punishable by up to 10 years in prison.

Peter Papaherakles, a U.S. citizen since 1986, was born in Greece. He is AFP’s outreach director. If you would like to see AFP speakers at your rally, contact Pete at 202-544-5977.